32+ what is a good dti for mortgage

Ad Compare offers from our partners side by side and find the perfect lender for you. In general you need a back-end DTI of 36 or lower.

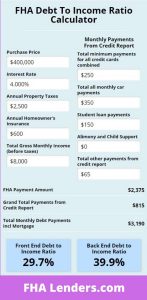

2023 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

Ideally lenders prefer a debt-to-income ratio lower than.

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

. While you may have a. Opportunity to improve Youre managing your debt adequately but you may want to consider lowering your DTI. DTI is 36 to 42.

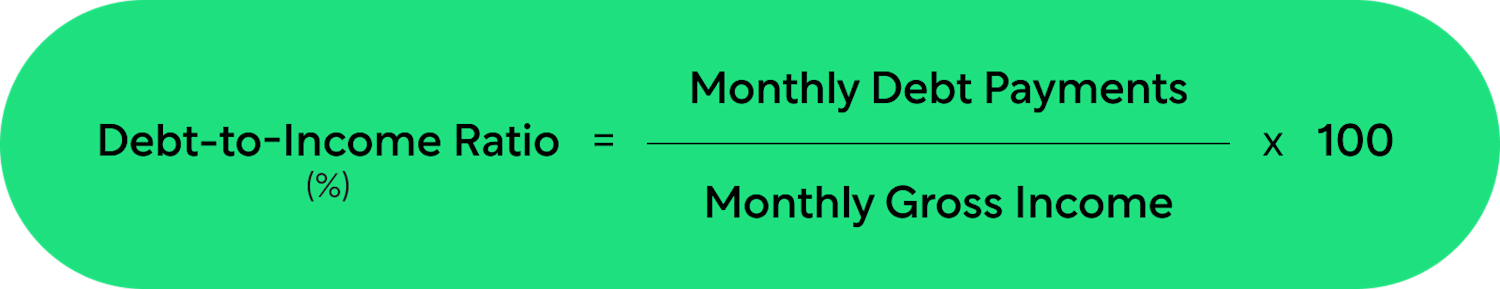

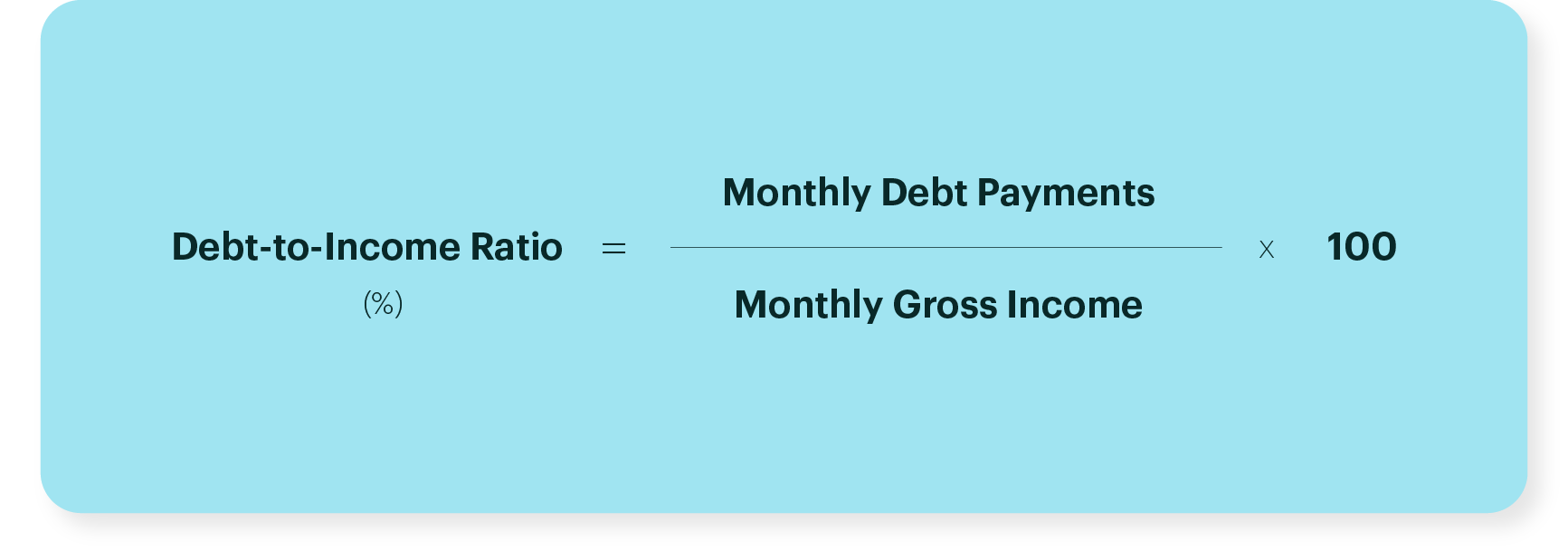

Ad Compare Best Mortgage Lenders 2023. Save Real Money Today. 1600 5000 032 Multiply the result by 100 and you have a DTI of 32.

FHA Loans FHA loans are. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web In a nutshell your DTI ratio is how much money you spend on your monthly debts versus the amount of money coming into your household.

Generally lenders prefer to see a debt-to-income ratio of less than. Your lender will also look at your total debts which. Web You would calculate your DTI as follows.

As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage. You shouldnt have trouble accessing new lines of credit. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

That said a lower debt-to. Web In most cases youll need a DTI of 50 or less but the specific requirement depends on the type of mortgage youre applying for. In other words 32 of your gross monthly.

Web DTI or debt-to-income ratio is an important calculation lenders look at during the mortgage application process. Ideally lenders prefer a debt-to-income ratio lower. Web DTI is less than 36.

A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a. Web DTI Ratios and Mortgages Your DTI ratio is a major factor in the mortgage approval process. Your debt is likely manageable relative to your income.

If your credit score is high enough conventional loans may allow for DTIs up to 50. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. By Barbara Marquand and.

Web Lets look at a real-world example. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

A higher ratio could mean youll pay more interest or be denied a loan. Save Time Money. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Most lenders prefer mortgage applicants who have a. 130 minimum monthly payment. Web Conventional loans.

Web What is a good debt-to-income ratio. Web Most conventional loans allow for a DTI of no more than 45 percent but some lenders will accept ratios as high as 50 percent if the borrower has compensating factors. Web What DTI should I aim for.

Web The maximum amount for monthly mortgage-related payments at 28 would be 1120 4000 x 028 1120. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Apply Online Get Pre-Approved Today.

Web A good DTI ratio to get approved for a mortgage is under 36. Web Lenders generally view a lower DTI as favorable.

What Is The Debt To Income Ratio Learn More Citizens Bank

The Secret Bias Hidden In Mortgage Approval Algorithms Center For Public Integrity

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

What Is A Good Debt To Income Dti Ratio

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Avx1qwi8zq35hm

Financial Assumptions Wont Help You Buy Your Dream Home

What Is A Good Debt To Income Ratio Better Mortgage

What Is A Good Debt To Income Ratio Better Mortgage

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Prepare Loan Compass

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans

Fha Debt To Income Dti Ratio Requirements 2021

How To Choose A Mortgage Lender Money

What Is A Debt To Income Ratio And How Does It Affect Your Mortgage Approval